estate tax exemption 2021 sunset

Unused credit amounts can be used over the next five years. Estate Tax Exemption.

If the estates gross value is less than this exclusion amount you may do nothing.

. A self-proving affidavit executed in accordance with s. By Heidi A. However there are a few provisions from the new tax law that have a 2019 effective date and some are retroactive.

This website may not reflect the most. Adds the definition of federal basic exclusion amount to both the Estate Tax Chapter 217 and the Gift Tax Chapter 228c. These changes conform the Estate and Gift Tax provisions with the thresholds in 2018 Conn.

TDS Rate Chart for the Year 2021-2022 Tax Deducted At Source Rate Chart. Seely and Matthew J. Any remaining child care credit from 2015 cannot be applied to the 2021 tax tax liability.

For instance in a financial year you earn INR 50000 as salary from your HUF. The exemption amount is inflation-adjusted and in 2021 was 117 million per individual. The Office of the Property Appraiser is continually editing and updating the tax roll.

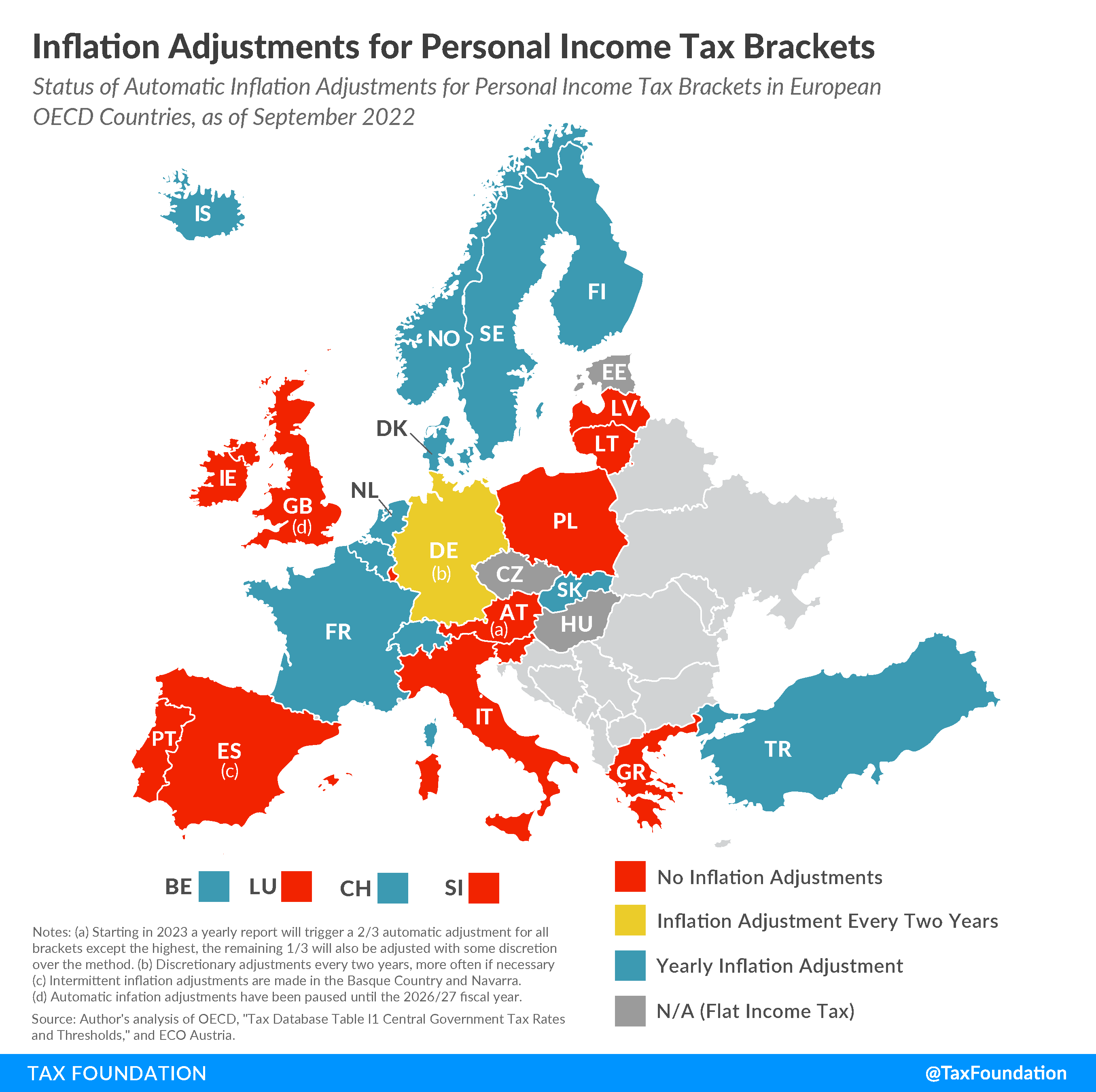

For the 2021 tax year credits from 2016 through 2020 can be applied on Line 5. The exemption amount will be cut in half for each taxpayer and is estimated to be around 62 million in 2026 after adjusting for inflation. Tax Brackets and Tax Rates Change for Most Taxpayers With the TCJA.

The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be. Enter the total amount of estimated tax payments made during the 2021 taxable year on this line. Your household income location filing status and number of personal exemptions.

Line 17 Withholding Form 592-B andor 593 Enter the 2021 nonresident or real estate withholding credit from Forms 592-B Resident and Nonresident Withholding Tax Statement or Form 593. Tax credits universal credit housing benefit. The estate tax in the United States is a federal tax on the transfer of the estate of a person who dies.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Share of income received from family income or income received from an impartial family estate would be exempted from tax. Unified Estate and Gift Tax.

With the 2017 Tax Cuts and Jobs Act passed and effective as of January 1 2018 the amount. 1 In all proceedings contesting the validity of a will the burden shall be upon the proponent of the will to establish prima facie its formal execution and attestation. The entitledto benefits calculator will check which means-tested benefits you may be entitled to eg.

A Washington estate tax return is required if the estate value is more than the state tax exclusion amount of 2193 million. For clarity any new tax preference for which an expiration date is intended should always expressly state the intended date even if the intent is to expire the preference under the ten-year default. These provisions are effective October 1 2022.

What Can I Do to Save on Washington Estate Taxes. 476104 LA Import Code 460 Act 292 of the 2021 Regular Legislative. Your estate tax exemption will be reduced if you made any taxable gifts during your lifetime that exceeded the annual exclusion from gift taxes 15000 in 2021 increasing to 16000 in 2022 and if you did not pay the gift tax on those transfers at the time.

If your estate is worth more than the 2193 million tax exemption it is possible. Therefore this edition is the 2021 Index and represents the tax climate of each state as of July 1 2020 the first day of fiscal year 2021 for most states. Ii Notwithstanding the provisions of subparagraph Bi of this subdivision for each taxpayer whose Connecticut adjusted gross income exceeds seventy-eight thousand five hundred dollars the amount of the taxpayers Connecticut taxable income to which the three-per-cent tax rate applies shall be reduced by one thousand six hundred dollars for each four thousand dollars or.

Most changes from the Tax Cuts and Jobs Act took effect on January 1 2018 and are slated to sunset after December 31 2025. Our income tax calculator calculates your federal state and local taxes based on several key inputs. For the month of June 2021 the new ITR filing software will be free of cost for taxpayers.

Qualified sick leave wages and qualified family leave wages for leave taken after March 31 2021 and before October 1 2021 are subject to both the employer share 62 and employee share 62 of social security tax 124 total. 7332012 is admissible and establishes prima facie the formal execution and attestation of. 732503 or an oath of an attesting witness executed as required in s.

Gifts can reduce taxes but maybe not in the way you think. ITR will be immediately processed leading to a quick income tax refund. If you have a sizeable estate another large opportunity to take advantage of before the 2025 sunset is the increased estate and gift tax exemption amount.

The 2017 Tax Cuts and Jobs Act temporarily doubled the estate tax exemption from 2018 through 2025 so it went from 549 million in 2017 to 1117 million in 2018 indexed for inflation. Under RCW 82328051a a new tax preference is subject to an automatic ten-year expiration date unless provided otherwise. The District of Columbia DC is only included as an exhibit and its scores and phantom ranks offered do not affect the scores or ranks of other states.

The applicability of ITR or Income Tax Return depends on the type of taxpayer and the income sources during the. The limit is expected to sunset in 2026 at which point it may be reduced to about 6 million. Exemption under Section 10 23BBH on income earned by.

Additional information on the increased flexibility and borrowing authority provided to the CLF under the CARES Act is detailed in Letter to Credit Unions 20. Line 16 2021 Estimated Tax. A single dashboard will represent all the tax-related interactions.

Check what benefit entitlement you are entitled to. How Income Taxes Are Calculated. The tax applies to property that is transferred by will or if the person has no will according to state laws of intestacyOther transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts.

General excise tax exemption for Foreign Diplomats and Consular Officials as applied to purchases and leases of personal or official motor vehicles Sample Motor Vehicle Tax-Exemption Letter. It will be equal to the difference between the total exemption available less the value of your lifetime gifts that. Sunset of Act 105 Session Laws of Hawaii 2011 Relating to Taxation.

These changes were to sunset on December 31 2020 but the Consolidated Appropriations Act 2021 extended each of the CLF CARES Act provisions described below through December 31 2021.

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Tax Flyers Tax Services Tax Refund Tax Prep

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Important Concerns Regarding Potential Reduction Of Lifetime Estate Tax Exemptions News Education Dewitt Llp

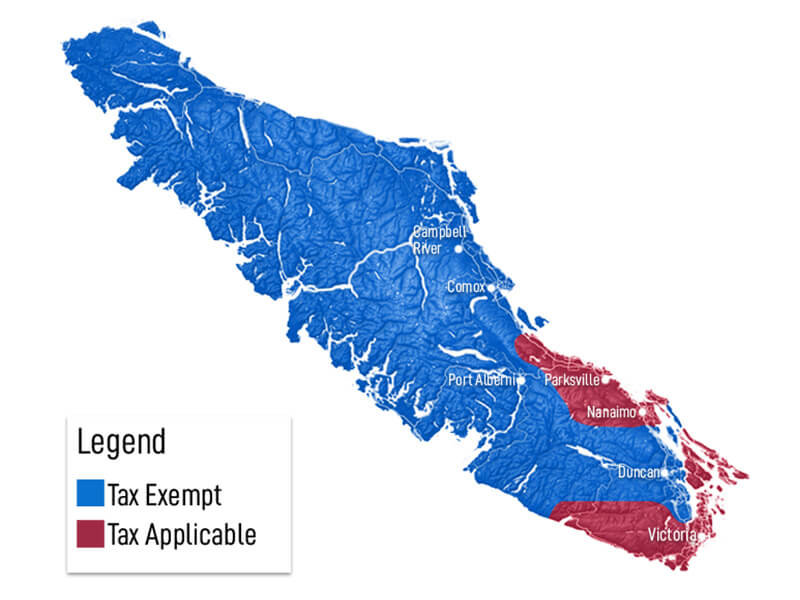

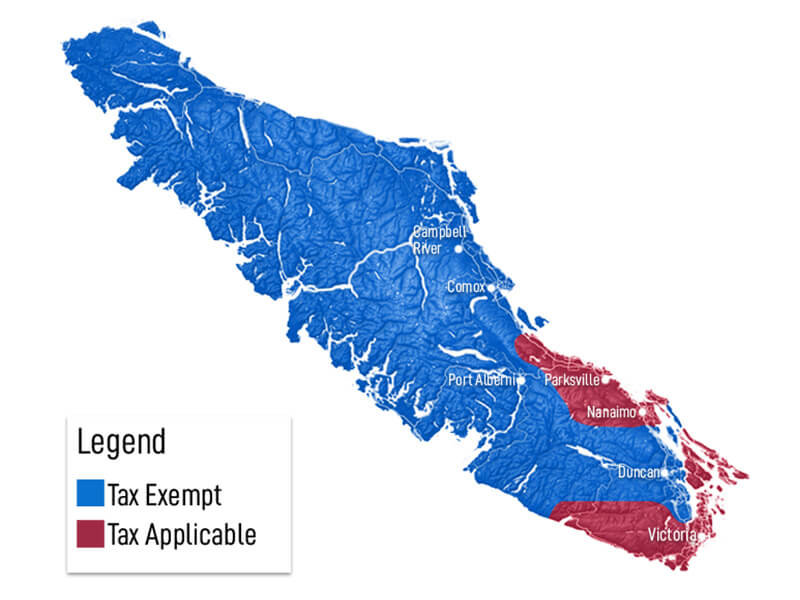

International Relocation Foreign Homebuyers Moving To Nanaimo

Retirement Death Tax Bank Reporting Provisions Stripped From Reconciliation Bill For Now

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

:max_bytes(150000):strip_icc()/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)